India-Africa trade in 2026 shows strong potential driven by economic complementarity, digital growth, and India’s focus on renewables, but faces challenges like China’s dominance, slow Indian project execution, connectivity gaps, political instability, and financing hurdles, requiring India to revive strategic dialogues (IAFS), enhance digital corridors, and reform project delivery to unlock deeper integration. Growth is propelled by India’s rising GDP and Africa’s demand for digital, pharma, and energy solutions, but scaling up needs coordinated strategies and overcoming logistical/bureaucratic barriers.

India–Africa Trade Relations in 2026

India-Africa bilateral trade surpassed $100 billion in FY 2024-25, nearly doubling from $56 billion in 2019-20, driven by strong growth in exports and imports. This momentum positions the partnership for continued expansion into 2026, with projections estimating $120 billion in bilateral trade. Key sectors include pharmaceuticals, petroleum, machinery, and agricultural products from India, alongside minerals and energy imports from Africa.

Bilateral trade grew 17% to $103 billion in FY 2025, balanced at $42-43 billion each direction, supported by India’s $75 billion investments and $12 billion loans in Africa. Key exports from India include machinery and drugs; imports feature minerals and petroleum.

“India-Africa trade has crossed $100 billion and New Delhi has emerged as one of the top-five investors in the continent. India has extended concessional loans worth over $12 billion and $700 million in grant assistance for projects across Africa, apart from offering 50,000 scholarships for African youth, of which more than 42,000 have already been utilized.”- Kirti Vardhan Singh, Minister of State for External Affairs

Also Read India–Africa Economic Relations After 2025: What Changed and Why it Matters?

India–Africa Economic Relations After 2025: What Changed and Why it Matters?

Growth Drivers

India-Africa trade growth is propelled by complementary economic strengths, strategic investments, and policy initiatives targeting $200 billion by 2031.

- Investment Flows: India has invested $75 billion cumulatively in Africa across energy, infrastructure, and manufacturing, fostering long-term partnerships. Concessional lines of credit totaling $12 billion support projects in 40+ countries, enhancing export capacities.

- Sectorial Synergies: Key drivers include India’s exports of pharmaceuticals, petroleum products, machinery, and automobiles, matched by Africa’s supply of minerals, oil, and gold. Emerging areas like renewable energy, digital payments (UPI adoption), IT services, and agri-tech boost mutual gains.

- Policy Initiatives: The African Continental Free Trade Area (AfCFTA) opens a 1.3 billion-person market for Indian firms, while scholarships (50,000+) and capacity-building programs strengthen ties. High-level summits and the planned 2026 India-Africa Partnership Summit accelerate momentum.

| Driver | Contribution |

|---|---|

| Investments & Loans | $87 billion total support |

| AfCFTA Access | Expanded market opportunities |

| Key Sectors | Pharma, energy, minerals trade |

Key Challenges

India-Africa trade faces hurdles like infrastructure deficits, regulatory barriers, and geopolitical risks that limit efficiency and scale despite strong growth momentum.

| Challenge | Specific Impact | Mitigation Efforts |

|---|---|---|

| Infrastructure Gaps | Poor logistics/ports raise costs 20-30%; weak cold chains limit agri-trade | India’s $12B loans fund roads/ports in 40+ countries |

| Regulatory Barriers | Non-tariff measures, licensing delay pharma/machinery; corruption deters SMEs | Harmonize standards via AfCFTA talks |

| External Risks | Instability disrupts minerals/oil; China/EU competition erodes share | Diversify via summits, tech partnerships |

| Global Slowdown | Trade growth at 2.6% in 2026 amid US tariffs | Focus resilient sectors like pharma/IT |

Current Trends in India-Africa Trade

India-Africa trade trends in late 2025 show robust growth, with bilateral volumes reaching $103 billion in FY25, a 17% year-on-year increase from $100 billion in FY24-25, driven by balanced exports and imports of roughly $42-43 billion each. Pharmaceuticals dominate India’s outflows at over $10 billion annually, complemented by petroleum products, machinery, rice, textiles, and automobiles, while imports center on critical minerals, crude oil, and gold to fuel India’s energy and manufacturing sectors. Emerging shifts include rapid expansion in healthcare, food processing, renewable energy, and digital services like UPI payments and IT/AI solutions, targeting Africa’s youthful demographics and 4% GDP growth amid AfCFTA integration.

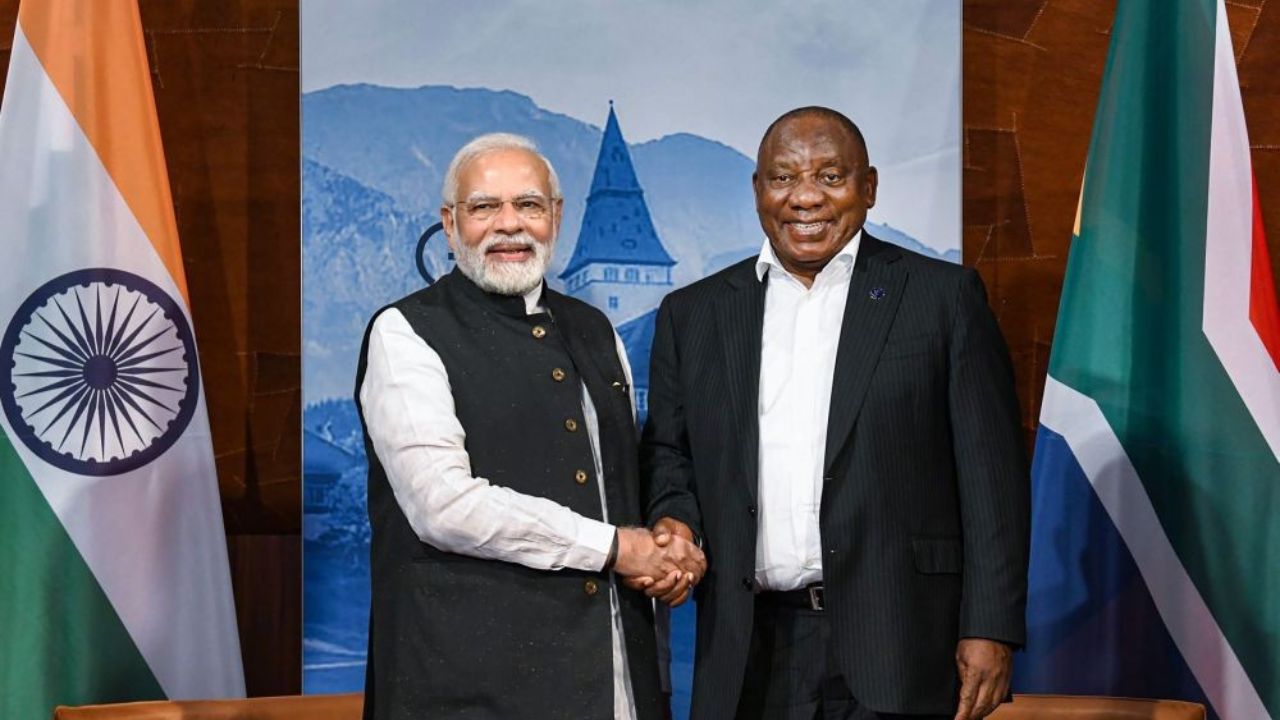

Recent initiatives underscore momentum, including $12 billion in concessional loans across 40+ countries, $700 million in grants, and utilization of 42,000 out of 50,000 scholarships to build capacity. India’s top-5 investor ranking with $75 billion cumulative commitments supports diversification beyond traditional markets like Nigeria, South Africa, and Tanzania, where exports exceeded $38 billion in FY24. CII-led conclaves and the Duty-Free Tariff Preference scheme further enhance value-added production and market access, positioning trade for sustained 10% CAGR toward the $200 billion target by 2031 despite global headwinds.

Future Outlook

India-Africa trade targets $200 billion by 2031 through 10% annual growth, leveraging AfCFTA and strategic partnerships amid India’s resilient 6.5% GDP expansion in FY26.

- Growth Projections: Bilateral trade eyes $120 billion in 2026, building on FY25’s $ 103 billion, with focus on value-added manufacturing and digital integration like UPI payments. Renewable energy, agri-tech, and IT sectors drive diversification beyond commodities.

- Strategic Initiatives: No comprehensive FTA yet, but sector pacts and the 2026 India-Africa Partnership Summit advance ties; 50,000 scholarships and capacity-building enhance people-to-people links. AfCFTA integration opens 1.3 billion consumers for Indian exports.

- Potential Risks: Global trade slowdown to 2.6% and US tariffs pose headwinds, but India’s pharma/energy resilience supports steady progress.

| Outlook Factor | Expected Impact |

|---|---|

| USD 200B Target by 2031 | 10% CAGR via AfCFTA/tech |

| 2026 Summit | Boost investments/partnerships |

| Sector Focus | Renewables/IT/agri growth |

| GDP Resilience | India’s 6.5% aids stability |

“India and Africa will collaborate to double bilateral trade by 2030, with a focus on value addition, technology-driven farming, renewable energy, and healthcare. Together, we can move from raw material exports to value-added production for global markets.”- Piyush Goyal, Union Minister of Commerce and Industry

FAQ’s

What is the current bilateral trade volume?

India-Africa trade reached $103 billion in FY 2025, up 17% from $ 100 billion in FY 2024-25, with balanced flows of $42-43 billion in exports and imports.

Which sectors drive India’s exports to Africa?

Pharmaceuticals lead at over $10 billion annually, followed by petroleum products, machinery, rice, textiles, and automobiles.

What is the trade growth target?

Partners aim to double trade to $200 billion by 2031 through 10% annual growth, leveraging AfCFTA and initiatives like 50,000 scholarships.

What are major challenges?

Infrastructure gaps raise costs 20-30%, non-tariff barriers limit access, and geopolitical risks disrupt chains amid competition from China/EU.